End of the Long Bond Era – Bloomberg

”I thought bonds were the boring, safe, simple thing” Summary This Bloomberg video explains the evolving dynamics and current challenges in the bond market, particularly[…]

The Art of Learning — KKR Macro

Insightful macro update from KKR With a whirlwind of recent developments — post-U.S. election tax debates, ‘Liberation Day’, and travels both abroad and at home[…]

How to Preserve Wealth Across Generations: Lessons from the Fall of the Vanderbilts

Preserving wealth is hard. Keeping it across generations is even harder. From Cornelius Vanderbilt to the forgotten names on Australia’s early rich lists, history is[…]

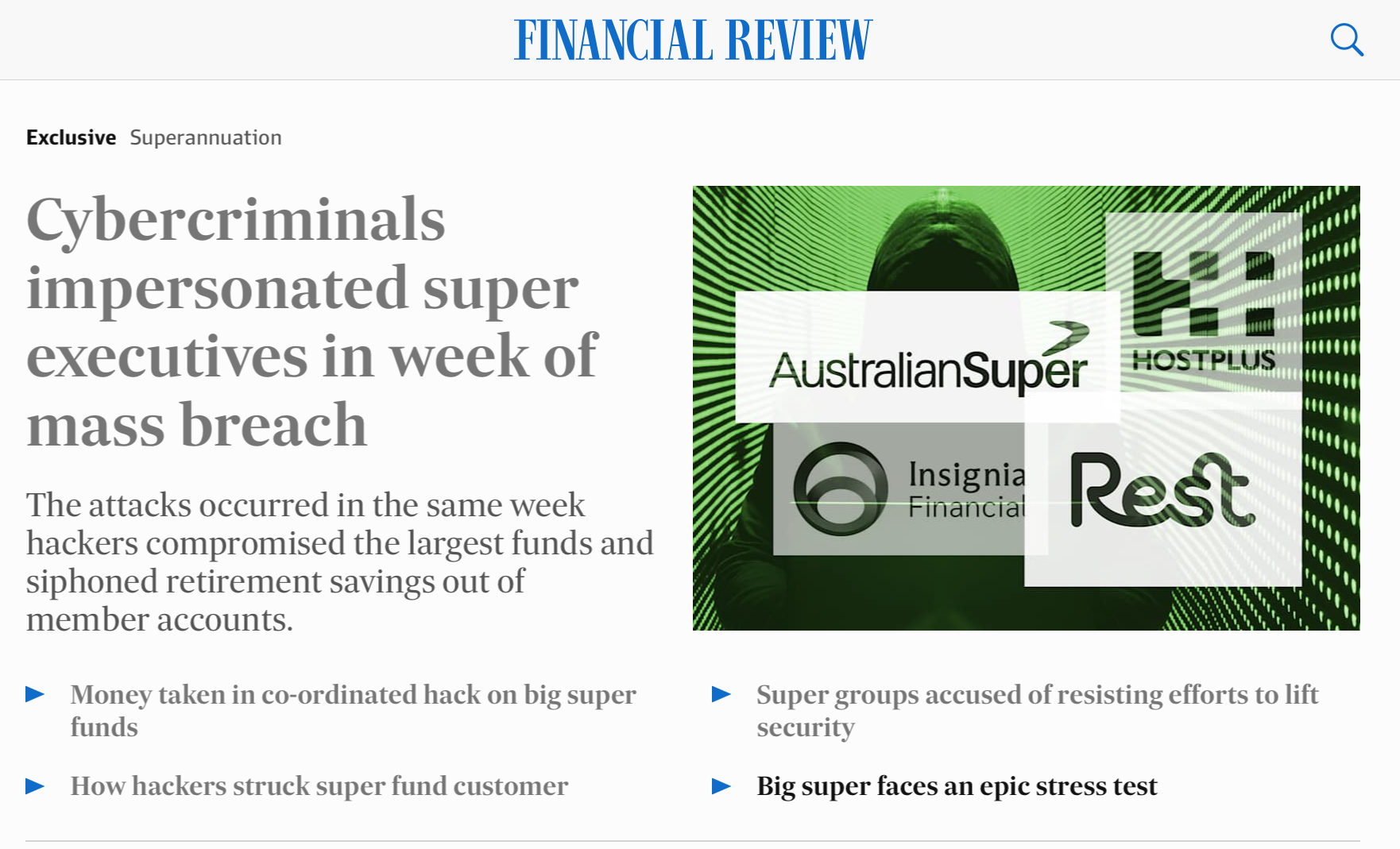

Can you rely on Big Super?

“Cybercriminals impersonated superannuation executives in a sophisticated mail scam that rocked the industry’s top organisations in the same week hackers compromised the largest retirement savings[…]

Is Big Super Enough? How Independent Financial Advice Measures Up

When it comes to planning for your financial future, especially your retirement, most Australians start with their super fund. And why not? Big Super funds[…]

Re: Mental Models – Navigating The Asteroid Field With Trump 2.0

The “Never Tell Me The Odds” Trump 2.0 Administration is attempting to put the country on a new trajectory. It’s a fraught path through an[…]

Positioning for a Shifting World: How Investors Should Be Thinking About US Equity Exposure in 2025

Australian investors are embracing exchange-traded funds (ETFs) like never before. January 2025 saw a record $4.6 billion in ETF inflows—a clear sign of growing enthusiasm[…]

Investing wisely is about preparing for a range of outcomes

Markets are turbulent and are likely to remain volatile for a while. In the US, President Trump and Treasury Secretary Scott Bessent are signaling: a[…]

Warning to big super: fix customer service, or we’ll see you in court

The trustees of big superannuation funds have been warned to prepare for regulators to come after them in court this year if they do not[…]